Are Vegas Residence Price ranges Sustainable? January Real Estate Summary

Properties in the Mountains Edge community are viewed in this aerial photograph taken above Las Vegas, … [+]

Las Vegas dwelling prices have arrived at all-time highs for the duration of the pandemic. This is has transpired in spite of an unprecedented pandemic-connected recession, with an unemployment fee that arrived at an all-time higher of 34.2% and nonetheless sits at roughly double the nationwide regular.

Although housing has grown much more unaffordable for most around the past yr, it is luxury Vegas true estate that has been driving the industry.

Luxury and “uber luxury” actual estate. “Las Vegas and Southern Nevada has not only blown away records on its luxury market place for 2020 that are up 38 percent for $1 million and earlier mentioned,” in accordance to Mashvisor, “but the uber-luxurious current market of $4 million-furthermore has hit heights never found just before in the valley and doubled its performance from 2019.”

In December by yourself, in accordance to the Multiple Listing Provider cited in the Las Vegas Overview-Journal, 129 houses priced $1 million and over improved arms in Southern Nevada, which consists of the Vegas Valley as perfectly as the smaller metropolitan areas of Pahrump, Boulder City, and Mesquite. These are often second, third, or fourth houses for wealthy, typically worldwide buyers that may well get rented out or stay vacant a great deal of the yr.

Driving this luxury-tilted authentic estate boom? Reduced desire costs, together with a pandemic-relevant and remote perform-connected exodus from coastal towns like San Francisco, Los Angeles, and New York, as nicely as numerous aspects special to Las Vegas.

Housing and unemployment charge. Unsurprisingly, housing selling prices and unemployment fees have a tendency to show a potent inverse marriage. According to Oct 2020 data, Nevada’s statewide unemployment declined to 12% statewide and dropped from 14.5% to 13.9% in Clark County, which consists of increased Las Vegas and two-thirds of Nevada’s 3.3 million people. That is down two-thirds from its April peak of 34.2%, but still greater than any significant US metropolitan space, and double the countrywide average of 6.7%. In Vegas, leisure and hospitality continue on to be hit the worst, with 21.4% a lot less work than a calendar year before, pre-pandemic. Leisure and hospitality make up about 25% of Nevada’s workers, so that is around 62,000 less employment.

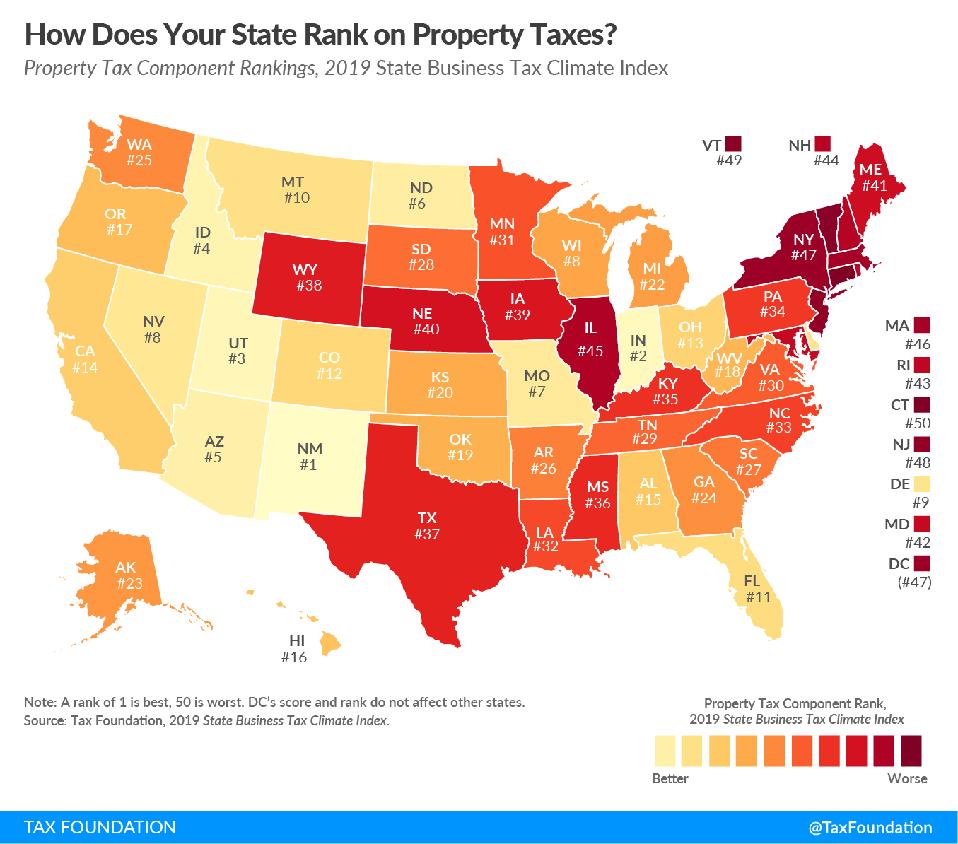

Nevada ranks #8 for most affordable home tax prices in the United States.

“Because these property cost traits do not match the existing economic local weather in Las Vegas, which proceeds to struggle, this rate development is not sustainable,” writes Mashvisor, a real estate analytics organization. “So it is very possible that residence rates will drop in the Las Vegas serious estate industry in 2021.”

CoreLogic, which showed a 6.4% boost in Vegas true estate year-in excess of-yr in 2020, predicts a 6.5% drop by August 2021. But that check out is not universally held. There continues to be a divergence of impression, as perfectly as the likelihood of increased divergence on distinctive forms of household true estate – together with rentals, standard, and luxury.

Serious estate obtained 4.7% nationally yr-above-yr in October, the past month with knowledge readily available, with housing begins up 14.2% year-around-yr, in accordance to the College of Nevada’s Center for Organization and Financial Study (CBER). But in Clark County, household housing permits/models dropped sharply – down 17.2% – relative to previous months and yr-around-12 months. This is one sign the authentic estate sector may perhaps be peaking. Stock is raising even as non-development unemployment stays large, as builders work to meet up with demand from customers.

Actual estate rates keep on to climb, in accordance to CBER. Present house gross sales have been up, but new gross sales went down from the thirty day period ahead of and yr-more than-year (from October).

Median residence costs have arrived at all around $300,000, according to CBER, with real properties offered averaging all-around $285,000. Zillow now functions about 5,000 household listings. According to Zillow and Fox 40, 61% of Vegas lookups on their web page come from non-regional resources, and practically 18% of individuals queries appear from the Los Angeles/Orange County place of California.

Las Vegas: special aspects. Preserve in thoughts that Las Vegas, due to the fact of its reliance on tourism and design, tends to have one particular of the most volatile economies in the US. But Sin City’s price of living is a lot lessen than most main metropolitan areas – approximately 50 % the value of residing as San Francisco, for illustration. Nevada also has no point out profits tax and very low residence taxes – position in the top rated ten, according to William Margita at Berkshire Hathaway Household Services in Las Vegas. It also has a favorable local climate, with delicate winters balancing out prolonged scorching summers. And Vegas has so considerably to do in and all around The Strip, as very well as being a distinctive key metropolis surrounded on all sides by the good outdoors. “Why are we accomplishing so nicely?” Margita writes. “We’re reasonably priced. We give a far better lifestyle for the cash and we nevertheless have almost everything that tends to make Las Vegas.”

Las Vegas is special in possessing huge tracts of undeveloped land in urban locations. (Image by George … [+]

Las Vegas is also exclusive, staying in the middle of the vast Mojave Desert, in that it is not “built out” like New York, San Francisco, or other geographically circumscribed city places. The Vegas Valley, which features Vegas, North Las Vegas, Henderson, and unincorporated communities, has additional undeveloped land readily available from in-fill and the Bureau of Land Management to subdivide and make households. This can set an upward brake on residence charges – but a rush of new developments can create a glut of stock and significant value crash, as it did during the Terrific Economic downturn when household prices crashed in excess of 60 %.

At the same time, for the reason that summers are hot and land has been traditionally affordable, people today make and invest in greater homes below. Just really do not hope a garden thanks to water conservation actions.

Observe on Business authentic estate. Vegas, like other towns, is viewing a change in professional uses as brick-and-mortar outlets and commercial offices already declining in use, accelerated trend throughout pandemic.